Are you considering applying for an Amex card? The American Express (Amex) card is renowned for its premium benefits and exceptional customer service. With various options tailored to different lifestyles, understanding the full scope of Amex cards can help you make an informed decision. In this comprehensive guide, we will delve into the world of Amex cards, covering everything from their benefits to the types available and tips for maximizing their use.

American Express has built a reputation as one of the leading credit card providers in the world. The Amex card is not just a payment method; it is a gateway to exclusive rewards, travel perks, and financial management tools. Whether you’re a frequent traveler, a business owner, or someone who enjoys cashback rewards, there is likely an Amex card that suits your needs.

In the following sections, we will explore the different types of Amex cards, their benefits, and essential tips for users. By the end of this article, you will be equipped with the knowledge needed to leverage your Amex card effectively. Let's dive in!

Table of Contents

Types of Amex Cards

American Express offers a variety of credit and charge cards, each designed for specific needs and preferences. Here are the main types of Amex cards available:

1. Personal Cards

- Amex Gold Card: Ideal for foodies and travelers, offering generous rewards on dining and grocery purchases.

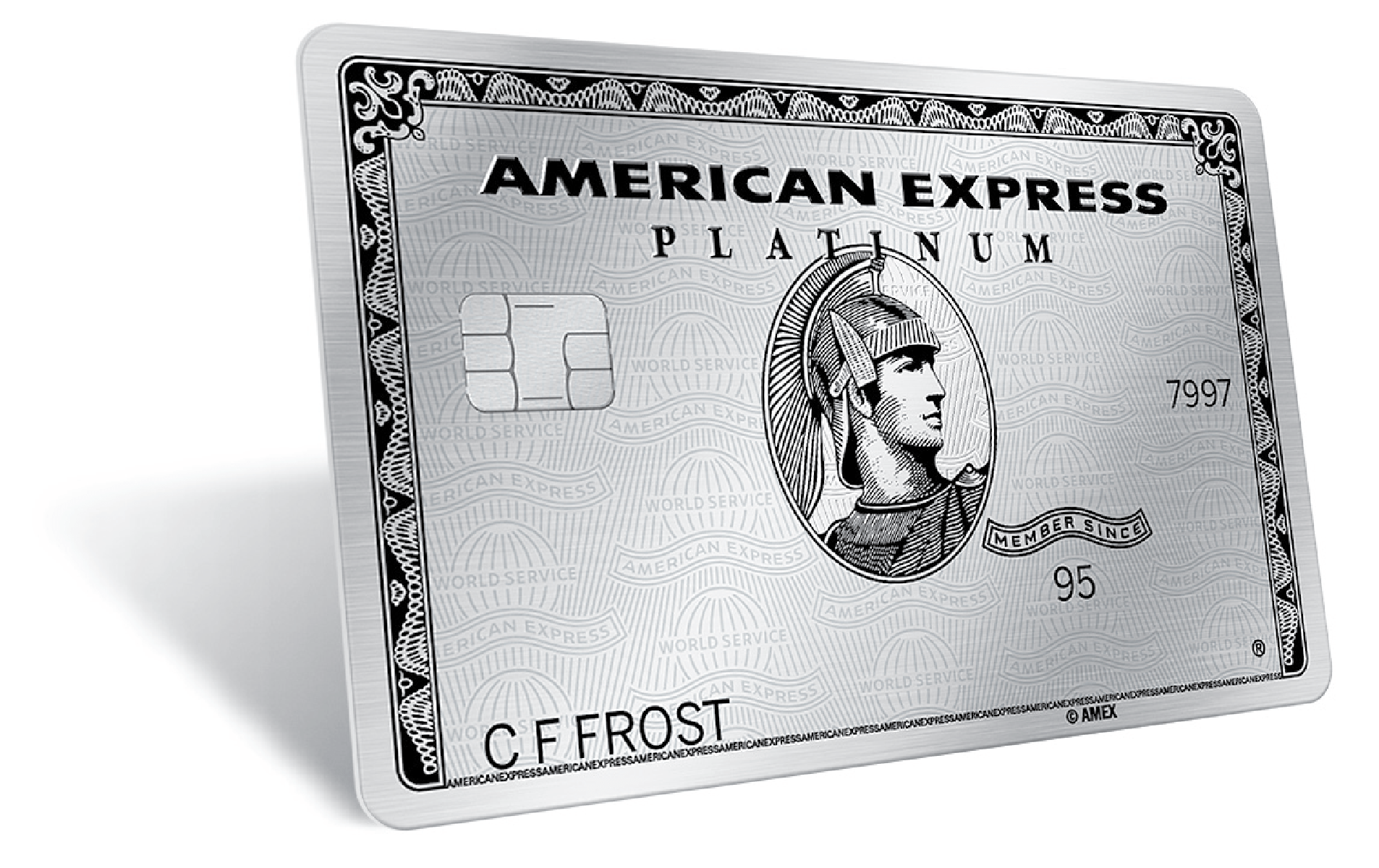

- Amex Platinum Card: A premium option that provides extensive travel benefits and access to luxury services.

- Amex Everyday Card: Great for everyday purchases with a unique rewards structure.

2. Business Cards

- Amex Business Gold Card: Tailored for small business owners, offering rewards on various business categories.

- Amex Business Platinum Card: Provides premium travel benefits and expense management tools for businesses.

3. Co-branded Cards

Amex also partners with various brands to offer co-branded cards, such as Delta SkyMiles cards that provide additional airline-related perks.

Benefits of Amex Cards

Owning an Amex card comes with various advantages, which can enhance your financial and lifestyle experience. Here are some key benefits:

- Rewards Programs: Amex cards typically come with robust rewards programs that allow you to earn points for every dollar spent.

- Travel Perks: Many Amex cards offer travel-related benefits, such as airport lounge access, travel insurance, and no foreign transaction fees.

- Exclusive Offers: Cardholders get access to exclusive promotions and events, including concerts and dining experiences.

- Purchase Protection: Amex provides purchase protection and extended warranties on eligible purchases.

How to Choose the Right Amex Card

When selecting an Amex card, it’s essential to consider your spending habits, lifestyle, and financial goals. Here are some tips:

- Evaluate Your Spending: Look at your monthly expenses to determine which card offers the most rewards based on your spending habits.

- Consider Annual Fees: Some Amex cards come with annual fees; weigh these against the benefits you will receive.

- Look for Sign-Up Bonuses: Many Amex cards offer substantial sign-up bonuses, so choose one that aligns with your goals.

Amex Card Rewards and Points System

Understanding the rewards and points system is crucial for maximizing your Amex card benefits. Here’s how it works:

- Membership Rewards: Many Amex cards allow you to earn Membership Rewards points, which can be redeemed for travel, merchandise, or statement credits.

- Earning Points: Points are typically earned for every dollar spent, with bonus categories offering higher rates.

- Redeeming Points: Points can be redeemed in various ways, including travel bookings, gift cards, or even transferred to airline partners for frequent flyer miles.

Managing Your Amex Card

Effective management of your Amex card is crucial for maintaining a healthy credit score and maximizing benefits:

- Pay on Time: Always pay your bill on time to avoid late fees and negative impacts on your credit score.

- Monitor Spending: Use the Amex app to track your spending and rewards in real time.

- Set Alerts: Enable alerts for due dates and spending limits to stay informed.

Amex Card Travel Benefits

The travel benefits provided by Amex cards are one of the most significant draws for many users. Here are some core advantages:

- Airport Lounge Access: Many Amex cards offer access to exclusive airport lounges, enhancing your travel experience.

- Travel Insurance: Coverage for trip cancellations, lost luggage, and travel delays is often included.

- Foreign Transaction Fees: Most Amex cards waive foreign transaction fees, making them ideal for international travel.

Common Questions About Amex Cards

Here are answers to some frequently asked questions about Amex cards:

- Is it worth paying the annual fee? If you utilize the benefits and rewards offered, the fee can be justified.

- Can I use my Amex card everywhere? While Amex is widely accepted, some places may not accept it, so it's good to have a backup card.

- What happens if I miss a payment? Late payments may incur fees and negatively affect your credit score.

Conclusion

In summary, the Amex card offers a plethora of benefits and rewards tailored to various needs and lifestyles. From travel perks to exclusive offers, understanding the different options available can help you choose the right card for your financial goals. Remember to manage your card effectively to maximize its benefits. If you have any questions or would like to share your experience with Amex cards, feel free to leave a comment below!

Thank you for reading! Explore more articles on our site for additional financial tips and insights.

ncG1vNJzZmirn521b6%2FOpmasp5idu6bD0pusrGpmZK6usddmmpqqlGO1tbnL